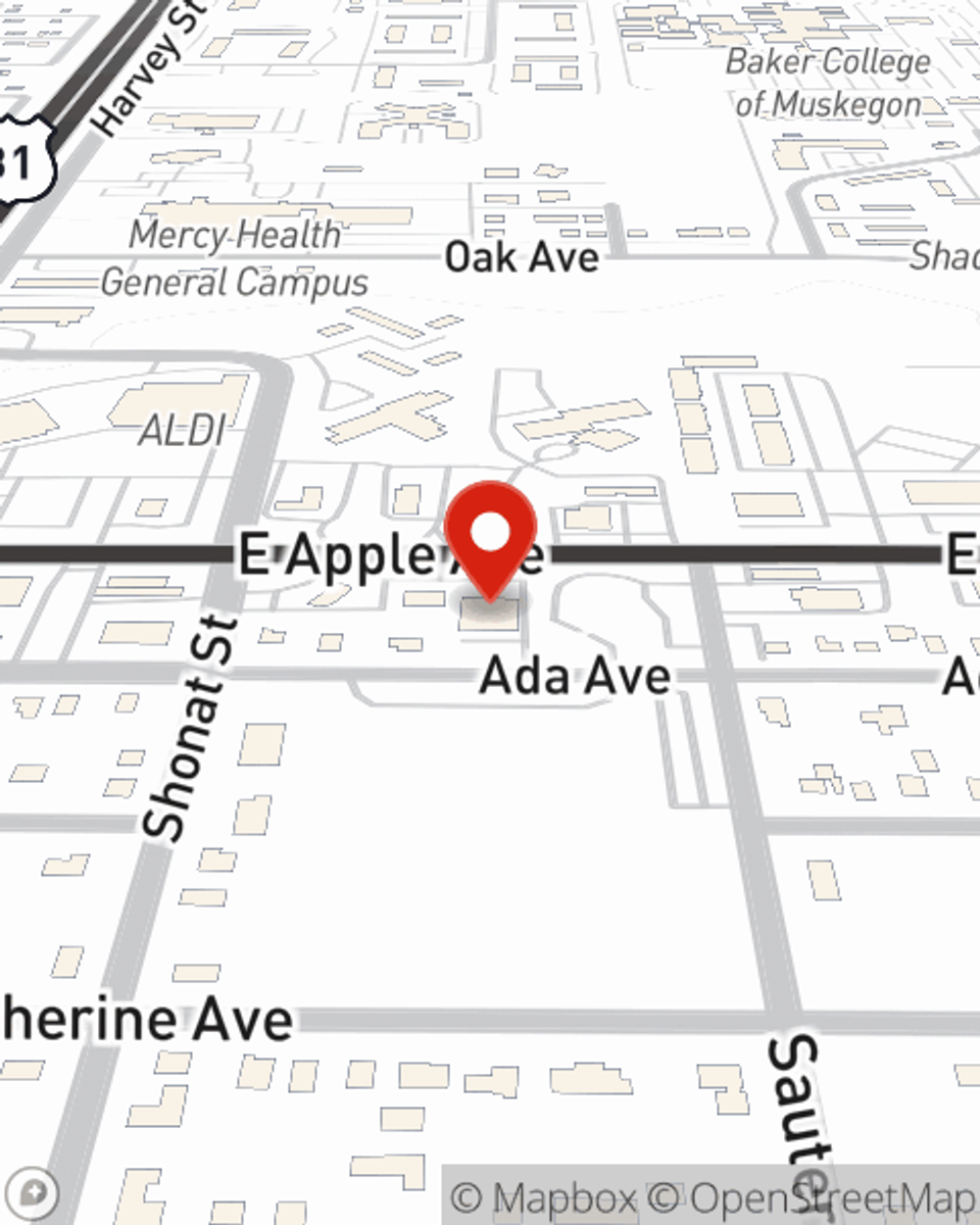

Life Insurance in and around Muskegon

Coverage for your loved ones' sake

Life happens. Don't wait.

Would you like to create a personalized life quote?

- Muskegon,

- Muskegon County

- Twin Lake

- Grand Haven

- Norton Shores

- North Muskegon

- Spring Lake

- Whitehall

- Montague

- Ravenna

- Fremont

- Hesperia

- Ferrysburg

- Grant

- Fruitport

- Shelby

- Hart

- Coopersville

- Cloverville

- Oceana County

- Ottawa County

- Newaygo County

- Kent County

- Holton

State Farm Offers Life Insurance Options, Too

If you are young and just starting out in life, it's the perfect time to talk with State Farm Agent Matt Crosby about life insurance. That's because once you start building a life, you'll want to be ready if tragedy strikes.

Coverage for your loved ones' sake

Life happens. Don't wait.

Their Future Is Safe With State Farm

Cost is one of the biggest benefits of getting life insurance sooner rather than later. With an insurance policy from State Farm, you can lock in fantastic costs while you are young and healthy. And your policy can be good for more than a death benefit. Learn more about all these benefits by working with State Farm Agent Matt Crosby or one of their dependable team members. Matt Crosby can help design a protection plan personalized for coverage you have in mind.

Did you know that there's now a life insurance option available that's perfect for someone who thought they couldn't qualify? It's called Guaranteed Issue Final Expense and it can really be of good use when it comes to covering the costs associated with final expenses like medical bills or funeral costs. Don't let these expenses burden your loved ones in the future - check out State Farm Guaranteed Issue Final expense from State Farm agent Matt Crosby for help with all your life insurance needs

Have More Questions About Life Insurance?

Call Matt at (231) 773-5225 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

How to use life insurance to help a special needs child or adult

How to use life insurance to help a special needs child or adult

From life insurance to a special needs trust, here's what you need to know to keep your loved one financially secure.

What is survivorship universal life insurance?

What is survivorship universal life insurance?

Survivorship universal life insurance can be used for legacy/estate planning, business transitions, charitable giving and more.

Matt Crosby

State Farm® Insurance AgentSimple Insights®

How to use life insurance to help a special needs child or adult

How to use life insurance to help a special needs child or adult

From life insurance to a special needs trust, here's what you need to know to keep your loved one financially secure.

What is survivorship universal life insurance?

What is survivorship universal life insurance?

Survivorship universal life insurance can be used for legacy/estate planning, business transitions, charitable giving and more.